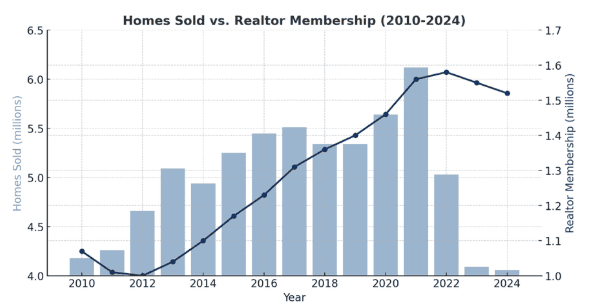

In the wake of the unprecedented housing market boom of 2021, the real estate industry experienced a massive influx of new agents. That year, U.S. home sales hit a 15-year high with 6.12 million properties sold, and Realtor® membership numbers surged to record highs—1.56 million in 2021 and topping out at 1.58 million in 2022, according to the National Association of Realtors (NAR). As history has shown, real estate booms typically trigger sharp increases in agent population. The allure of high commissions and abundant opportunity brings new entrants into the profession.

But what happens when the boom ends?

Beginning in 2022, the housing market began to contract—sharply. Skyrocketing interest rates, rising inflation, and declining affordability pushed sales downward. In 2023 and 2024, home sales plummeted to multi-decade lows, leaving many to assume that agent counts would follow traditional trendlines, shrinking as fast as they had expanded.

However, as we noted in our last article, Realtor® membership has remained surprisingly stable. Despite widespread market contraction, NAR’s reported agent totals have only seen marginal dips. This unusual retention rate has led many industry leaders to question whether we’re on the brink of a delayed mass exodus—or if we’ve simply entered a new era in agent career dynamics.

At Maverick Systems, we wanted to go beyond the headline numbers and ask a more important question: Of the agents who joined the industry during the pandemic-fueled boom, how many are still active today—and how productive are they?

Realtor® membership has remained surprisingly stable. Despite widespread market contraction, NAR’s reported agent totals have only seen marginal dips. This unusual retention rate has led many industry leaders to question whether we’re on the brink of a delayed mass exodus—or if we’ve simply entered a new era in agent career dynamics.

Using MLS and transaction-level data across several key markets, we tracked the cohort of agents who entered the industry in 2021. We then analyzed their current status and production volume in 2024. What we found was both revealing and concerning:

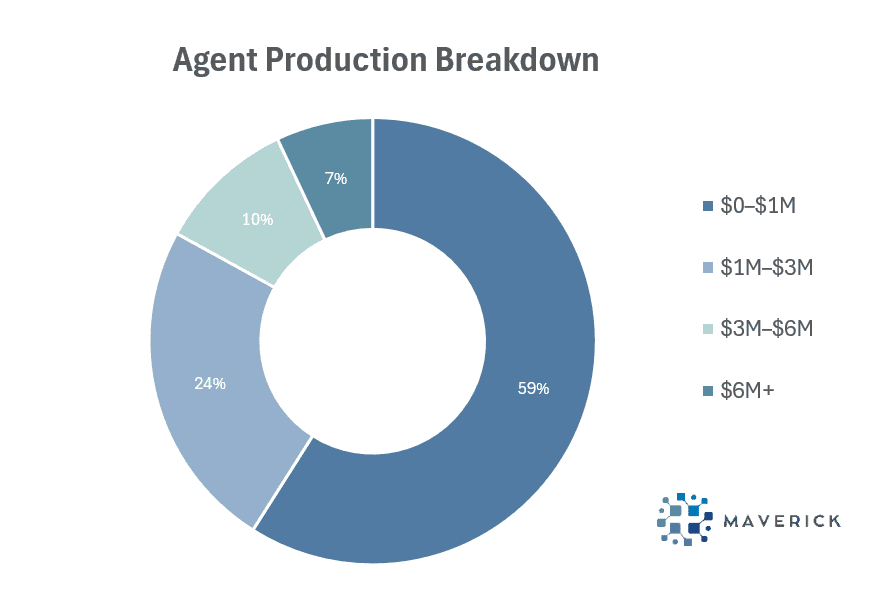

While 97% of agents who were active in 2021 remained active in 2024, the agent production numbers paint a sobering picture. While the raw count of active agents hasn’t drastically declined, the majority of agents still in the business are producing at very low levels. Nearly 60% of the 2021 cohort are doing under $1M in sales annually—a volume that, after expenses, leaves little room for sustainable income.

What This Means for the Industry

This data presents a paradox: the quantity of agents has remained relatively constant, but the quality—as measured by production and market contribution—has significantly eroded. This has important implications for brokerages, industry associations, and even consumers.

1. Brokerages must rethink recruiting and retention strategies.

With over half of these agents barely producing, retaining agents without a clear plan for productivity growth is an expensive burden. Data-driven coaching, targeted training, and more intentional onboarding are no longer optional—they’re essential for survival in a margin-compressed environment.

2. Top producers are more valuable than ever.

In this environment, the top 10–15% of agents are doing the vast majority of business. Brokerages need to identify, recruit, and retain these high-performing individuals with precision, not guesswork. That’s exactly where Maverick Systems comes in.

3. A delayed reckoning may be coming.

While agent counts have not yet declined sharply, the data suggests many are hanging on by a thread. As expenses rise, or secondary income becomes necessary, we could see a wave of quiet attrition in the coming quarters—just delayed rather than avoided.

4. Production gaps lead to service gaps.

Consumers working with low-volume agents may face inconsistent service quality, and that has ripple effects for the perception of the profession overall. It’s in the industry's best interest to ensure that active agents are not only present but proficient.

Understanding Retention and Recruitment Risk Through Data

Agent retention and recruitment have always been critical to brokerage success—but in a slower market, the stakes are even higher. With fewer transactions to go around, knowing which agents may be at risk of leaving—and which outside agents might be ready to make a move—is essential for managing growth and stability.

Internally, brokerages should regularly review production data to identify potential flight risks. Some common signals include:

- Large, sudden swings in production (especially negative trends)

- A spike in canceled or withdrawn listings

- Reduced engagement in office events, team meetings, or communications

These behaviors don’t always mean an agent is leaving, but taken together, they may suggest someone is reevaluating their place in the business—or within the firm.

Brokerages should also watch for agents who are quietly exiting the business altogether. Agents who haven’t transacted in several months and who show negative year-over-year production may be winding down operations, even if they haven’t formally left.

On the recruitment side, data can help identify high-potential agents early—often before they’re noticed by competitors. Signs of an up-and-comer might include:

- Fewer than 3 years in the industry

- At least 6 closed sides in the past 12 months

- 1–2 listing closings, indicating growing seller trust

Spotting this group early allows you to build relationships while they’re still forming their professional identity and evaluating long-term brokerage fit.

At Maverick Systems, we provide the data—and we don’t stop there. We analyze your internal and market-level information to uncover who in your organization is at risk of leaving, who may be quietly exiting the business, and which external agents are emerging as top recruiting prospects.

You’ll receive clear, customized insights: who to watch, why they matter, and what steps to take next. We help your leadership team focus on the right conversations by identifying key patterns—like sudden drops in production, spikes in canceled listings, or early signs of rising talent—and pairing each with recommended actions.

From surfacing the right data to streamlining follow-up, Maverick Systems gives you the full picture—and helps you respond before it’s too late or someone else moves first.

Schedule a demo today!