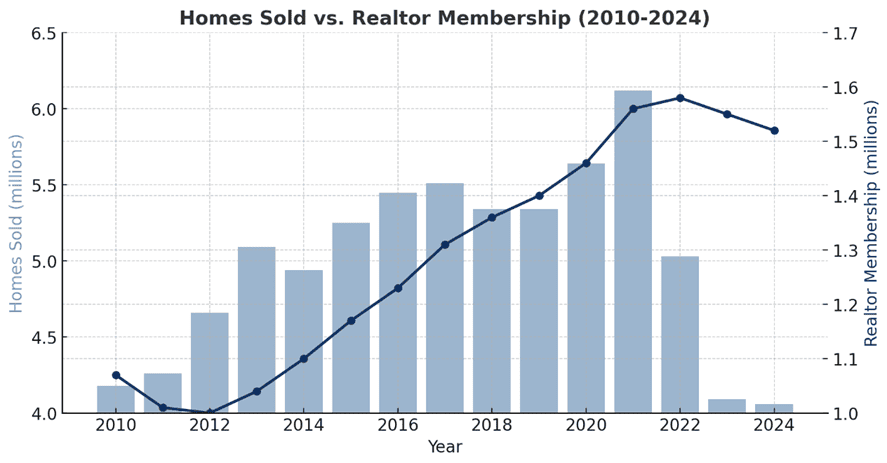

Almost a year ago, we wrote an article for HousingWire that pointed to key data suggesting that the real estate industry could be on the verge of a mass exodus of agents. Rising mortgage rates, declining home sales, and shifting commission structures all pointed toward an industry where fewer agents could thrive. But looking at the latest data, one thing stands out: while home sales have dropped significantly, Realtor membership hasn’t declined nearly as much as expected.

So, what’s happening? Why are so many agents still hanging on when past downturns saw sharper declines? And will the shakeout still come?

Market Reality: Fewer Sales, More Competition

The latest numbers tell a clear story: the number of homes sold has plummeted from 6.12 million in 2021 to an estimated 4.06 million in 2024. That’s a steep decline, cutting deeply into the opportunities available to real estate professionals. Historically, we’d expect Realtor membership to follow suit. Instead, while membership has dipped slightly from its peak of 1.58 million in 2022, it remains at 1.52 million—still higher than pre-pandemic levels.

The big question is: If sales have fallen so sharply, why are so many agents still holding on?

Key Factors Influencing Agent Retention

Several factors contribute to agents remaining in the industry:

- Pandemic Boom Aftershock

The 2020-2021 real estate frenzy drew in a record number of new agents, many of whom haven’t experienced a true down market. With memories of easy deals still fresh, many are hoping the market rebounds soon rather than making an immediate exit.

- The Gig Economy Effect

Unlike past downturns, agents today have more options to supplement their income. Many are working part-time, leveraging remote jobs, or even driving for gig-based services while keeping their license active.

- The Sunk Cost Fallacy

Agents who invested heavily in branding, marketing, and lead-generation during the boom years may be reluctant to walk away. Having spent thousands on systems and coaching, they’re holding on in hopes that their efforts will eventually pay off.

- Brokers and Coaches Pushing Retention

In previous downturns, the industry narrative often signaled that weaker agents should leave. This time, brokerages and real estate coaches are preaching patience, telling agents that persistence will separate the winners from the quitters.

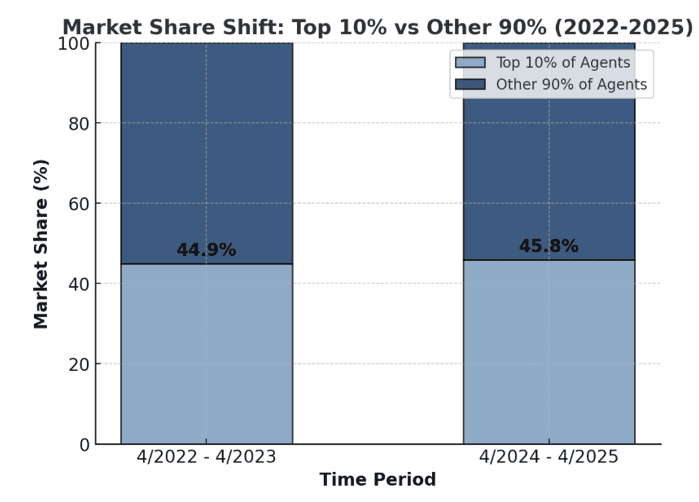

The Widening Productivity Gap

While overall agent membership has remained high, the distribution of transactions is shifting. The real estate industry is seeing a significant shift in market concentration, with top-performing agents securing a growing share of transactions. In 4/2022 - 4/2023, the top 10% of agents handled 44.9% of all transactions, and by 4/2024 - 4/2025, their market share had edged up even further to 45.8%.

At first glance, the shift in market share—rising from 44.9% to 45.8% for the top 10% of agents—may seem minor. But in a low-sales environment, this results in thousands of additional transactions consolidating at the top. As high-performing agents continue to expand their dominance, mid- and lower-tier agents are left competing for an increasingly limited share of deals. This gradual but persistent trend suggests a long-term industry shift toward consolidation, where success is increasingly concentrated among a shrinking pool of elite agents.

A Market That Rewards Adaptability

Success in today’s real estate market is becoming less about the sheer number of agents and more about who can operate the smartest. Top agents are not just surviving—they’re thriving, increasing their market share and closing more transactions, while the remaining 90% are finding it increasingly difficult to gain traction. The gap between those excelling and those struggling is steadily becoming wider, and for many, this means facing a difficult choice: adapt or risk falling behind.

A Restructured Industry

If this pattern continues, the industry could undergo a fundamental shift in how business is conducted. Rather than supporting a vast number of agents closing only a few deals per year, the market may begin favoring a more concentrated group of highly efficient, tech-enabled professionals. Brokerages and teams that fail to embrace data, automation, and targeted marketing strategies may find it increasingly difficult to remain competitive, while those who pivot to efficiency-driven models will be better positioned for long-term success.

Key Insights from the Data: The Industry’s New Reality

· Sales Are Down, But Agents Are Staying – Despite fewer home sales, Realtor membership remains high as agents hold on, banking on a market rebound or supplementing income elsewhere.

· Top Agents Are Taking Over – The top 10% now control nearly half of all transactions, leaving the majority competing for fewer deals. This is a growing trend that we expect to continue.

· Old Tactics Don’t Work – Traditional prospecting and passive lead generation are failing, while top agents thrive on data, automation, and targeted marketing.

· Adapt or Fall Behind – Success now depends on speed, strategy, and tech-driven efficiency—those who don’t evolve may not last.

Future Outlook: An Industry in Transition

The long-anticipated mass exodus of agents may not happen overnight, but the signs of industry consolidation are becoming more apparent. Rising costs, shrinking commission structures, and declining transaction volumes for lower-producing agents will likely push more professionals out over time.

For brokerages and teams, this creates both a challenge and an opportunity. Those who proactively leverage data, focus on high-value relationships, and optimize their technology stack will come out ahead. The real estate industry is shifting—the only question is who will be prepared for what comes next.

At Maverick Systems, we help brokerages and teams navigate these changes with data-driven recruitment, retention, and coaching strategies. Want to see how? Let’s talk. Schedule a demo at https://calendly.com/mavericksystems/demo.